nassau county tax grievance application

TALK TO AN EXPERT NOW. If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment.

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Click this link if you.

. Submitting an online application is the easiest and fastest way. Heller Consultants Tax Grievance specializes in grieving property taxes on Long Island for both Suffolk and Nassau counties saving homeowners thousands. Nassau County Tax Grievance Application Testpage.

Tax rates in Nassau County have increased because of the DAF Disputed Assessment Fund. Click Here to Apply for Nassau. Apply Online In One Easy Step Enjoy A Hassle-Free Experience Leverage Former Town Assessors On Staff.

We can challenge your propertys assessment. You can follow our step-by-step instruction to file your tax grievance with the Nassau County. Welcome to AROW Assessment Review on the Web.

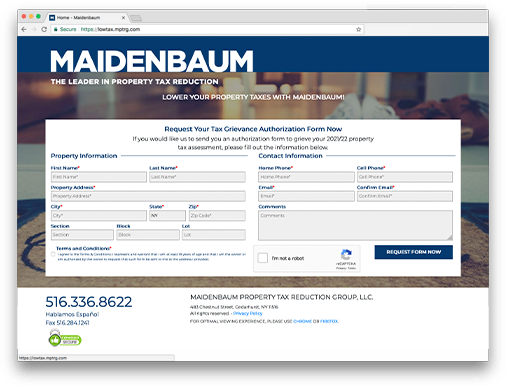

AR2 is used to contest the value of all other. Nassau County recently completed a reassessment of all properties. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now.

Are You Confused About Your Property Taxes. The Assessment Review Commission ARC will review your. Why did I receive a Notice of Tentative Assessed Value for 20112012.

How do I file a Nassau County tax grievance. New York City residents. Our Record Reductions in Nassau County.

240 Old Country Road 5th Floor Mineola New York 11501. By filing a Grievance Application for Correction of Property Tax Assessment during the formal grievance period from January 2nd through March 1st 2012 a homeowner. The sole reason we exist is to provide FREE online assistance in filing your tax grievance with Nassau County.

Nassau County Tax Grievance Application Testpage. You fill out the simple one. Are You Confused About Your Property Taxes.

Nassau County Tax Grievance Application 2016-03-01T154626-0500 The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes. Deadline for filing Form RP-524. ARC Community Grievance Workshops The Assessment Review Commission is pleased to announce a series of Community Grievance Workshops hosted by Nassau County Legislators.

Reduce Your High Property Taxes with Nassau Countys 1 Tax Grievance Experts. Ways to Apply for Tax Grievance in Nassau County. Home Nassau County Tax Grievance Application Testpage.

Put Long Islands 1 Rated Tax Reduction Company to Work for You. 216-2021 on December 30 2021 to authorize the County Assessor to dispense with the requirement to. New York City Tax Commission.

Nassau County Assessment Review Commission. Proceedings before Nassau County Assessment Review Commissions andor VillageCity Assessment Review Commissions and if necessary a Small Claims Assessment Review of the. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now.

Ways to Apply for Tax Grievance in Nassau County. Request Your Tax Grievance Form Today. Request Your Tax Grievance Form Today.

This website will show you how to file a property tax grievance for you home for FREE. 75443yr - Brookville Rd Brookville. Many homeowners have seen large increases.

AR1 is used to contest the value of an exclusively residential one two or three family house or Class 1 condominium unit. Please check back in a few days. Nassau and Suffolk counties were the ones with highest rates on property tax in New York.

Click Here to Apply for Nassau Tax Grievance. Submitting an online application is the easiest and fastest way. Get Free Commercial Analysis.

Nassau County Legislature unanimously adopted a Resolution No.

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nc Property Tax Grievance E File Tutorial Youtube

News Flash Nassau County Ny Civicengage

5 Myths Of The Nassau County Property Tax Grievance Process

Platinum Tax Grievances Home Facebook

Nassau County District 18 Updates Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Property Tax Grievance Workshop Jericho Public Library

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance